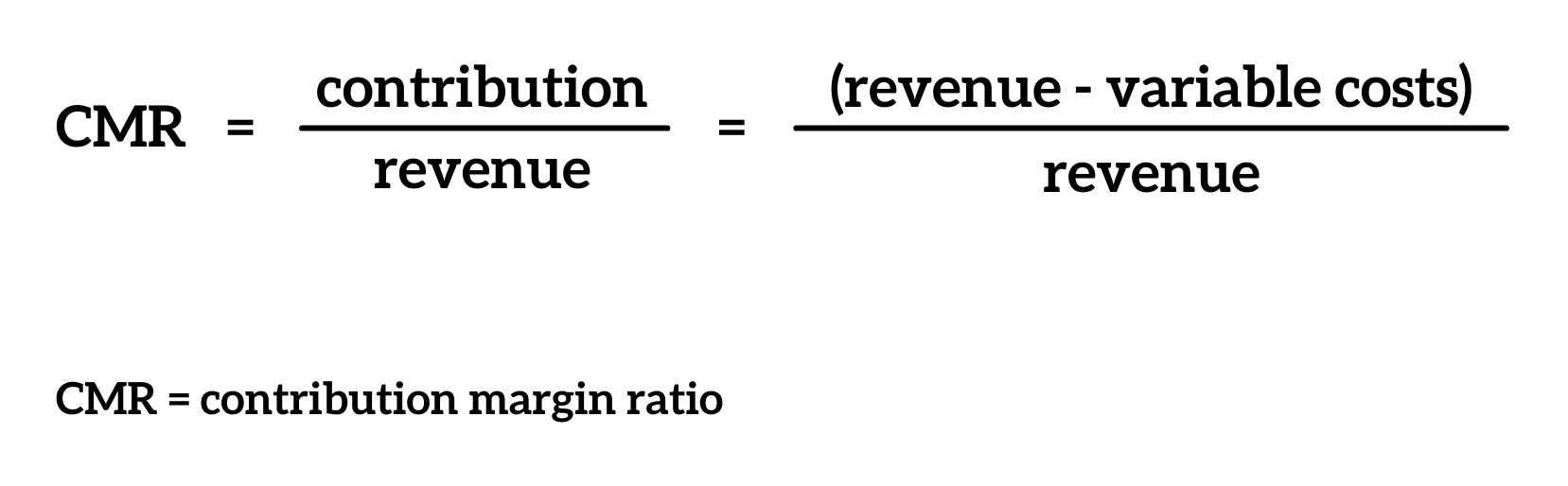

Another income statement format, called the contribution margin income statement11 shows the fixed and variable components of cost information. Note that operating profit is the same in both statements, but the organization of data differs. The contribution margin income statement organizes the data in a way that makes it easier for management to assess how changes in production and sales will affect operating profit. The contribution margin12 represents sales revenue left over after deducting variable costs from sales. It is the amount remaining that will contribute to covering fixed costs and to operating profit (hence, the name contribution margin). After we know the variable expenses, we can calculate the contribution margin ratio.

Utilizing Contribution Margin to Determine Break-Even Point

This information is often shared in income statements for external review, showing how the business is doing overall. Of the many different financial statements professionals might deal with on any given day, one of critical importance is known as the contribution margin income statement. What makes this statement so important is its ability to show profit potential. It serves as a specialized document in financial analysis that strips down revenue into critical components and provides an at-a-glance view of a company’s variable and fixed costs relative to its sales. In essence, if there are no sales, a contribution margin income statement will have a zero contribution margin, with fixed costs clustered beneath the contribution margin line item.

Variable Costs

It’s important to note this is a very simplified look at a contribution margin income statement format. Variable costs are not consistent and are directly related to the product’s manufacture or sales. They tend to increase as a company scales products and decrease with production. Some other examples of fixed costs are equipment and machinery, salaries that aren’t directly related to the product’s manufacturing, and fixed administrative costs. Thus, the total variable cost of producing 1 packet of whole wheat bread is as follows.

Calculate Contribution Margin: Your Complete Guide to Gross Profit and Margin Analysis in Income Statements

Regardless of how much it is used and how many units are sold, its cost remains the same. However, these fixed costs become a smaller percentage of each unit’s cost as the number of units sold increases. The fixed production costs were $3,000, and fixed selling and administrative costs were $50,000. Variable production costs were $1,000 per unit, and variable selling and administrative costs were $500 per unit. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.

Fixed Cost vs. Variable Cost

These two amounts are combined to calculate total variable costs of $374,520, as shown in panel B of Figure 5.7. The contribution margin income statement is a superior form of presentation, because the contribution margin clearly shows the amount available to cover fixed costs and generate a profit (or loss). It is useful to create an income statement in the contribution margin format when you want to determine that proportion of expenses that truly varies directly with revenues. As you will learn in future chapters, in order for businesses to remain profitable, it is important for managers to understand how to measure and manage fixed and variable costs for decision-making.

Do you already work with a financial advisor?

One of the primary benefits of contribution margin analysis is its ability to illuminate the profitability of individual products or services. By calculating the contribution margin for each offering, businesses can identify their high-margin winners and low-margin losers. This insight empowers strategic decision-making, allowing companies to allocate resources wisely and focus efforts where they’ll yield the most significant returns. Fixed costs are costs that may change over time, but they are not related to the output levels. These costs include equipment rent, building rent, storage space, or salaries (not related directly to production. If they are, you count them as variable costs). A contribution margin is a gap between the revenue of a product and the variable costs it took to make it.

Request a free demo and see how Cube can help you save time with all your contribution margin income statements, reports, analysis, and planning. It is primarily used for external financial reporting, providing a comprehensive overview of a company’s financial performance. Some common examples of variable costs are 30% of business failures are caused by employee theft raw materials, packaging, and the labor cost of making the product. These costs don’t fluctuate with the level of production or sales an item makes—which is why they’re sometimes called fixed production costs. No matter how much a company sells, the office rent still needs to be paid—so this is a fixed cost.

- Such an analysis would help you to undertake better decisions regarding where and how to sell your products.

- This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year.

- A university van will hold eight passengers, at a cost of $200 per van.

- What’s left is the contribution margin, which gives a sense of how much is left over to cover fixed expenses and make a profit.

Any remaining revenue left after covering fixed costs is the profit generated. In its simplest form, a contribution margin is the price of a specific product minus the variable costs of producing the item. What’s left is the contribution margin, which gives a sense of how much is left over to cover fixed expenses and make a profit. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. The concept of contribution margin is applicable at various levels of manufacturing, business segments, and products. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs. A key characteristic of the contribution margin is that it remains fixed on a per unit basis irrespective of the number of units manufactured or sold. On the other hand, the net profit per unit may increase/decrease non-linearly with the number of units sold as it includes the fixed costs. A contribution margin income statement deducts variable expenses from sales and arrives at a contribution margin.

A higher contribution margin ratio signifies that a larger portion of each sales dollar is available to cover fixed costs and generate profit. This is particularly significant because it suggests the business has a stronger ability to absorb fluctuations in sales volume or variable costs without sacrificing profitability. The contribution margin income statement is how you report each product’s contribution margin—a key part of smart operating expense planning. It separates fixed and variable costs to show which products or services contribute most to generating profit. Unlike a traditional income statement, the expenses are bifurcated based on how the cost behaves.

Add Comment